Bitcoin Price Prediction: Can Bitcoin Reach $1,000,000 by 2025?

Jul 17, 2023

Rashi Maheshwari

2022 has been very rough for all the cryptocurrencies including Bitcoin. In fact, the largest cryptocurrency of the world, Bitcoin has lost nearly 65% of its market value in the entire year of 2022. Crypto enthusiasts were caught off guard by a series of unfortunate events such as the Terra Luna crash, fall out of the largest crypto exchange FTX, and the looming macroeconomic conditions.

But there are several questions which are hovering on everyone’s mind: what will happen next? Will Bitcoin ever rise again in 2023? Or, will it crash just like in 2022?

Here’s a detailed read which will help you to find out all the possibilities for Bitcoin prices in 2023.

Will Bitcoin Rise Again In 2023?

The world’s largest cryptocurrency, Bitcoin is once again following the path to recovery, as the coin has surged almost 1% over the past one week, trading at 30,500, adding up to the monthly gain of 12.87%, according to the latest charts retrieved by CoinMarketCap. Bitcoin, which had an unstable flow till last due to various micro and macro factors, finally crossed the psychological threshold of $31,000 mark.

due to various factors such as dollar weakening, cooling inflation data, pause in rate hike in the U.S., has led to the Bitcoin recovery since the last two weeks.

According to CoinMarketCap, in the last 24 hours, the global cryptocurrency market has surged nearly 1.37% , standing at $1.19 trillion.

Before this rally, Bitcoin had fallen below $26,000 and was trading at three-months low when the U.S. Securities and Exchange Commission, SEC has sued one of the leading cryptocurrency exchanges, Binance and its founder and chief executive officer, Changpeng Zhao (CZ). Bitcoin was trading in the downward trajectory as one of the largest cryptocurrency exchanges, Binance, got into trouble with the U.S. SEC over mishandling of consumers’ funds and violating securities law.

In its complaint, the U.S. SEC blamed Binance for creating separate entities as Binance.US and Binance.com , as part of an elaborate scheme to evade US federal securities laws. It has also alleged that a firm owned by its founder CZ, was involved in artificially increasing the trading volume of crypto assets which were listed on its Binance U.S. platform.

Crypto experts believe that, if Bitcoin sticks to its resistance level of $30,000, then a bounce back could be likely from here, however breaking the same level can even lead it to the lowest of $28,000 levels.

At the time of writing, the global cryptocurrency market capitalization is trading around $1.19 trillion. According to CoinMarketCap, the volume of all stable coins is now $26.23 billion, which is 91.01% of the total crypto market 24-hour volume and Bitcoin’s dominance is currently 49.71%, an increase of 0.10% over the day, at the time of writing.

Before this, in April 2023, the top cryptocurrency by market value, Bitcoin touched the key resistance level of $30,000, for the first time since June 10, 2022 and then started dipping below till the levels of $26,000. Experts believe that thus Bitcoin must stick to the levels of $31,000 and more so that it could touch $60,000 by the end of this year.

However, the road to recovery is long, as Bitcoin is still down almost 50%, from its all-time high. which crossed $69,000, in November 2021.

At the start of the year 2023, the world’s largest cryptocurrency, Bitcoin, plunged under the levels of $20,000. But due to factors such as deepening banking crisis in the U.S., weakening of the dollar index and cooling inflation have been able to bring back Bitcoin and other digital currencies to lead the path of resistance. So, it will not be wrong to say that the recent financial crisis in the U.S. has enhanced the appetite for the cryptocurrencies, which are referred to as an alternative to the conventional banking system.

While the future of Bitcoin remains unknown, retail investors need to be very watchful and cautious about each and every move of Bitcoin, as it has been quite a tumultuous year for Bitcoin. Bitcoiners should not forget that the currency is still trading almost 50% low from its all-time high. The reasons for such volatility has been the macroeconomic conditions of the major markets such as the U.S. and the UK.

Moreover, India’s stance on cryptocurrencies continues to be tough with the government bringing all crypto-related transactions under the ambit of the Money Laundering Act. In a specific gazette notification, the Union Finance Ministry of India stated that all the transactions related to virtual currencies or digital assets would fall under the purview of Prevention of Money Laundering Act (PMLA).

At the face of it, the new development may appear detrimental to the crypto community in India. On ground, the move has been lauded by the industry-at-large as this is a step towards regulating this space, where in absence of regulators, the enforcement agencies will directly take recourse to any discrepancies.

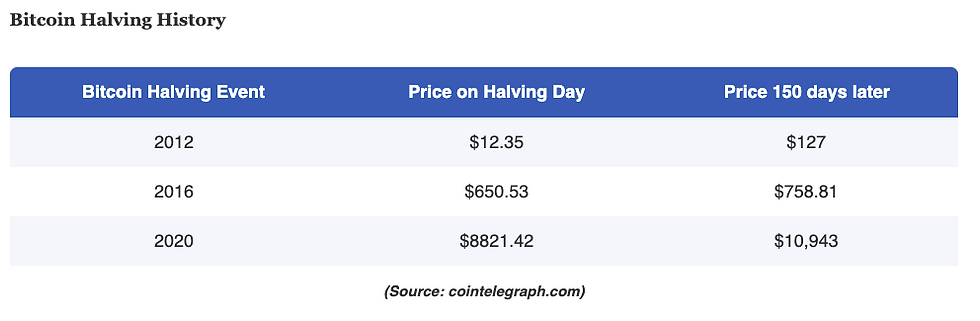

One of the other reasons why experts are bullish on Bitcoin is that, next year, 2024, is a year for Bitcoin’s halving event. The Bitcoin halving event happens every four years in which Bitcoin rewards to its miners are cut in half, (miner’s payout will be reduced to 3.125 BTC). This event is generally viewed as positive for Bitcoin’s price, as halving helps in contracting supply. Historically, halving has been seen as a very good sign for bringing momentum in Bitcoin’s price.

So, if we closely observe the data, past Bitcoin halving events have been able to establish long-term bullish drivers for Bitcoin’s price. The Bitcoin halving event directly relates to its deflationary tendency and squeezes its supply, which helps the BTC price to rise further. As Bitcoin, being a decentralized cryptocurrency, cannot be printed by governments or any central banks, and thus the total supply of Bitcoin is limited.

Moreover, large investors which are known as “Bitcoin Whales”, have started accumulating BTC once again. According to data from on-chain aggregator Santiment, the large Bitcoin whales are holding between 1,000-10,000 BTC in their wallets, indicating that investors have been filling up their wallets with a lot of BTC, which might show the recovery sign in the price of Bitcoin.

Can Bitcoin Reach $100,000 by 2023?

We all know that BTC has rallied more than 80% since the start of this year. With such massive and unexpected gains, it has surely outpaced several other major assets and given tremendous returns to those who have bought BTC at dips.

The industry is really excited to witness the new peak of the world’s largest cryptocurrency and hoping for more. Marshall Beard, chief strategy officer at U.S. based cryptocurrency exchange Gemini, believes Bitcoin to break all-time highs this year. He said, “$100,000 price figure is an “interesting number if Bitcoin gets to its previous record high of near $69,000”.

If Bitcoin really touches this magical figure, then it has to show an upside of 270% to reach at the level of $1 lakh.

Paolo Ardoino, chief technology officer at Tether, also has quite an optimistic view of Bitcoin. He said Bitcoin could “retest” its all-time high near $69,000.

Nonetheless, 2023 seems to be a good year for Bitcoin advocates, who always consider it as a “safe-haven investment” or “digital gold” which can offer investors a good hedging opportunity or attractive return in times of mayhem.

Bitcoin, which got a major boost on hopes that the U.S. financial and banking situation can reduce the chances of more aggressive interest rate hikes by the U.S. Federal Reserve.

Can Bitcoin Reach $1,000,000 by 2025?

Bitcoin lovers always have too bright and at times impossible predictions for their favorite currency. And, post this mini-bull run, there are several discussions running around that the world’s largest digital coin, BTC, could even witness a level of $10 lakh by the year 2025.

This notable and hypothetical figure of $10 lakh has been echoed by a number of prominent personalities in the crypto space.

Recently, one of the leading British Multinational Banks, Standard Chartered, raised its prediction price for Bitcoin from $1,00,000 to $1,20,000 by the end of 2024 in one of its latest research reports citing more profitability to Bitcoin miners. The MNC bank forecasted BTC to reach $50,000 by the end of this current year.

The Chinese-Canadian Bitcoin entrepreneur and CEO of crypto firm, JAN3, Samson Mow, believes the cryptocurrency will reach $1 million in the next five years.

With more such wild guesses, Balaji Srinivasan, an investor and the former technology chief at Coinbase, took a bet that Bitcoin could reach $10 lakh or even more in mere 90 days.

Srinivasan made this strong statement on the belief that as the world goes in the stage of hyperinflation, the dollar value will get weak and thus people will start buying more and more Bitcoins. “Hyperinflation” means extremely rapid increase in the price of goods and services over a period of time.

On the other hand, crypto experts believe Bitcoin might touch $10 lakh in upcoming years, but not so soon, and predicting this level in 2023 or in 90 days is just next to impossible.

Marshall Beard, chief strategy officer at U.S. based cryptocurrency exchange Gemini, stated “Bitcoin to be a million dollars in 90 days, some crazy things are happening in the world, which we don’t want,” he said, however, that it might take 10 years to reach anywhere close to this extreme prediction.

Will Bitcoin Crash Again in 2023?

(The Bearish View)

There are another set of investors, corporates, and large institutions who hold an opposite view (bearish) on Bitcoin and firmly believe that Bitcoin might fall in the near future. They considered this rally as a major “bull trap” rather than a “bull run”. Veteran global investor, Mark Mobius, the billionaire founder of Mobius Capital Partners, already predicted a huge fall in 2022 and said that Bitcoin could even fall to the $10,000 range.

Similarly, the same is predicted by another maverick investor, Matthew Sigel, head of digital assets research at VanEck, a global investment manager, sees Bitcoin to drop to $12,000 levels, citing higher energy prices.

Moreover, global bank Standard Chartered’s prediction on Bitcoin is super surprising. They predicted that Bitcoin could fall to $5,000 levels in 2023.

Experts believe that the rising interest rates and tighter monetary policy will not allow Bitcoin to rebound sharply in the near future. As in this kind of uncertain market, investors will not prefer to invest or buy risky assets such as Bitcoin. And, those who have been holding BTC, might sell their positions, creating undue pressure on the markets again.

How Should Indian Investors Approach Bitcoin in 2023?

With such varied predictions on Bitcoin, what should be the approach of Indian crypto investors? With such uncertainty around, maybe it is the best time to observe the Bitcoin moves carefully rather than taking any action which might lead to severe losses. Even the Indian crypto industry experts believe that it is a wait-and-watch mode for crypto investors and any further action must be taken very carefully.

Sathvik Vishwanath, the co-founder and CEO of Unocoin, believes, “Investor sentiment toward bitcoin remains mixed, reflecting caution in the face of rising interest rates and a strengthening US dollar.

He strongly feels that Bitcoin will remain a popular investment choice and its underlying technology continues to attract interest from various industries. As with any market, the future direction of Bitcoin and other cryptocurrencies is difficult to predict. However, the impact of rising interest rates and inflation concerns will remain significant factors to watch in the coming months.

Avinash Shekhar, founder and CEO of TaxNodes, stated that crypto investors should make informed investment decisions. Investors need to formulate an investment strategy according to their investment goals. Based on their investment goals and targeted returns, a pre-decided weight must be allocated to crypto as an asset class.

He believes, to protect their capital base, investors should not invest huge chunks of their savings in crypto but instead, put in small amounts periodically.

On the contrary, certain market experts have full faith in Bitcoin and expect it to rise again. Raj Karkara, chief operating officer of ZebPay, seems quite bullish on Bitcoin. He said “The fundamentals of Bitcoin remain rock solid irrespective of the market conditions.”

“Bitcoin can rise again in 2023 provided there are no macroeconomic headwinds,” says Karkara. He also feels that crypto traders and investors should research extensively on the fundamentals and technicalities of an asset before taking a buy or sell decision. Also, using a systematic investment plan (SIP) approach in Bitcoin can help investors hedge against market volatility.

Bottom Line

There are several views and predictions on Bitcoin, some are bullish and some are bearish. Only time will tell where Bitcoin will head next. Bitcoin, which is known for its resilient nature, carries a huge capacity for comebacks. For the past decade, several veteran experts have predicted that the Bitcoin bubble will burst soon. However, the poster boy of cryptocurrency is still favored by many and has also helped investors make substantial fortunes over time.